Money, often dubbed the lifeblood of modern society, holds the potential to evolve and grow. In the vast landscape of personal finance, one tool stands out as a beacon of financial empowerment: compound interest.

This magical force has been heralded by some as the “eighth wonder of the world,” and rightfully so.

In this comprehensive guide, we will delve into the intricacies of compound interest, exploring how it has the power to make money, save money, and serve as an indispensable tool for those seeking to build wealth.

1. The Basics of Compound Interest

Before we dive into the depths of compounding, let’s establish a fundamental understanding of what compound interest is.

At its core, compound interest is the concept of earning interest not only on your initial principal but also on the interest that accumulates over time.

Unlike simple interest, which is calculated solely on the principal amount, compound interest has the remarkable ability to make your money work for you at an accelerated rate.

Simple Interest vs. Compound Interest

Imagine having $1,000 in a savings account earning 5% annual interest. With simple interest, you’d earn $50 each year, maintaining a consistent return.

However, with compound interest, the interest earned is added back into the principal, creating a compounding effect.

In the second year, you’d earn 5% not just on the initial $1,000 but on the new balance of $1,050, resulting in $52.50.

As this cycle continues, your money grows exponentially, showcasing the power of compounding.

2. Understanding the Formula

To truly appreciate the potential of compound interest, it’s beneficial to grasp the formula that governs its calculations:

A=P(1+r/n)nt

Here, A represents the amount of money accumulated after n years, including interest; P is the principal amount; r is the annual interest rate; n is the number of times interest is compounded per year, and t is the number of years.

This formula serves as the mathematical engine driving the compounding phenomenon.

While you don’t need to manually calculate it, understanding the components enables you to appreciate the variables that contribute to the growth of your wealth.

3. Variables Affecting Compound Interest

Several key variables influence the outcome of compound interest:

Interest Rate (r): The higher the interest rate, the more money you earn or owe. It’s a critical factor in determining the growth or cost of your money.

Starting Principal (P): Your initial deposit or loan amount significantly impacts the ultimate outcome. Whether you’re saving or borrowing, the starting principal sets the stage for compounding.

Frequency of Compounding (n): The pace at which interest is compounded, whether daily, monthly, or annually, plays a pivotal role. More frequent compounding results in faster growth or accumulation of debt.

Duration (t): Time is the unsung hero of compounding. The longer you leave your money to grow or your debt to accumulate interest, the more pronounced the compounding effect becomes.

Deposits and Withdrawals: Regular additions or withdrawals from your account influence the principal balance and, consequently, the impact of compounding. Strategic decisions in this regard can optimize your financial outcomes.

4. Compound Interest in Action

Now that we’ve laid the groundwork, let’s witness compound interest in action through a real-world example.

Consider a scenario where you deposit $5,000 into a savings account with a 5% annual interest rate, compounded monthly, for 10 years.

Using the compound interest formula, the future value (A) of your investment would be calculated as:

A=5,000(1+0.05/12)12×10

This calculation reveals that after 10 years, your investment would grow to approximately $8,238.35.

The magic lies in the compounding effect, showcasing how consistent, incremental growth over time can lead to substantial returns.

5. Making Compound Interest Work for You

Now that we’ve demystified compound interest let’s explore how you can leverage this powerful tool to make money, save money, and build lasting wealth.

Give Yourself Time: The most significant advantage of compound interest is time. Starting early allows you to harness the full potential of compounding. This is particularly relevant when saving for retirement. The longer your money is invested, the less of your own money you need to contribute to reach your financial goals.

Aggressively Pay Down Debt: While compound interest can work wonders for savings, it can equally pose a challenge when it comes to debt. The faster you pay down debts, the less you’ll owe over time. This is particularly crucial for high-interest debts like credit cards, where compounding can quickly lead to a substantial balance.

Compare Annual Percentage Yields (APYs): Whether you’re saving or investing, understanding the Annual Percentage Yield (APY) provides a more accurate representation of what you’ll earn or be charged in interest. APY accounts for compounding, making it a crucial metric for informed financial decisions.

Check the Rate of Compounding: The frequency at which interest compounds matters. In an ideal scenario, you’d want your savings to compound as frequently as possible, optimizing growth. On the flip side, minimizing the compounding frequency for debts helps reduce the overall interest burden.

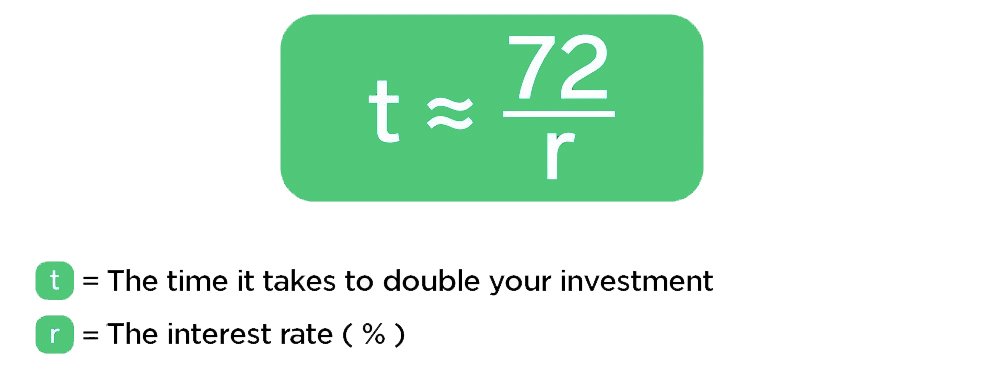

Interesting Fact: The Rule of 72

Here’s an interesting tidbit about compound interest that many might not know: The Rule of 72.

This nifty rule is a quick and easy way to estimate how long it takes for an investment to double in value. Simply divide 72 by your investment’s expected rate of return.

For instance, if you expect a 9% return, your investment would double in approximately 8 years (72 divided by 9 equals 8).

It’s a handy rule for those looking to gauge the potential growth of their investments.

Conclusion

In the realm of personal finance, compound interest emerges as a beacon of financial prosperity.

It has the power to transform small, consistent efforts into substantial financial gains.

Whether you’re starting to save, investing for the future, or managing debts, understanding and harnessing the force of compounding can make a significant difference.

As you embark on your financial journey, remember that time is your ally, and compound interest is the magic that can turn your financial goals into reality.

So, seize the opportunity, invest wisely, and let the power of compound interest propel you toward a wealthier and more secure future.

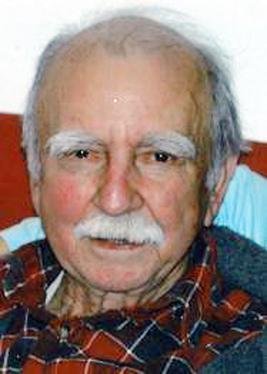

Interesting Fact: The Janitor Millionaire

Meet Ronald Read, a janitor from Vermont who turned a small investment into an $8 million fortune.

Image: By https://www.nbcnews.com/news/us-news/vermont-ex-janitor-bequeaths-secret-millions-library-hospital-n301396, Fair use, https://en.wikipedia.org/w/index.php?curid=60434392

Starting with modest trades in the 1950s, Ronald purchased 39 shares of Pacific Gas & Electric for $2,380.

Over 60 years, he diligently bought and reinvested dividends, owning shares in over 95 businesses.

Ronald’s disciplined approach, focusing on businesses he understood and those paying dividends, led to the remarkable growth of his wealth.

He left behind a legacy of $8 million, a testament to the power of compounding and patient investing.