Greetings, Defactopedians! Today, we embark on a fascinating journey through time, exploring the captivating evolution of currency, from primitive barter systems to the revolutionary era of Bitcoin.

Join us as we uncover the significant milestones that have shaped the way we perceive and utilize money.

1. Barter: The Cradle of Exchange

Let’s take a journey back to ancient times and explore the origins of economic exchange—enter the age-old practice of barter.

Picture lively markets where goods and services effortlessly changed hands, sidestepping the need for standardized currency.

In this economic dance, a farmer might swap bushels of crops directly for a skilled artisan’s handmade tools, showcasing a straightforward and tangible form of reciprocity.

Around 6000 BC, Mesopotamian tribes pioneered bartering, later adopted by Phoenicians for essential goods like food, weapons, and spices.

Even the mighty Roman soldiers got in on it, bartering their services for the coveted resource of salt.

Colonists in Colonial America? They were all about barter, proving the resilience and adaptability of this ancient practice.

In the grand tapestry of economic history, barter takes center stage as the cradle of exchange, weaving a story that stretches from ancient marketplaces to our modern considerations.

As we journey through time, the echoes of bartering resonate, a reminder of the intricate dance that set the stage for the complex economic systems we navigate today.

2. The Birth of Coinage: Shaping a Standard

Advancing through the corridors of time, we find ourselves in ancient civilizations like Mesopotamia and Egypt, where the concept of standardized mediums of exchange began to take shape.

Precious metals, particularly gold and silver, emerged as pioneers in this evolutionary journey.

Around the 6th or 5th century BCE, a mysterious turning point unfolded—the invention of coins.

According to varying accounts, Herodotus credits the Lydians as the first minters, while Aristotle proposes Demodike of Kyrme, wife of King Midas of Phrygia.

Numismatists lean towards Aegina, a Greek island, as the origin, attributing the first coins to either local rulers or King Pheidon of Argos.

image: Lydian Stater

The Lydian Stater, an intriguing precursor to coins, deserves a special mention.

Before the conventional coin, the Lydians, hailing from Asia Minor, introduced standardized metal ingots stamped with symbols, laying a foundation for future coinage systems.

Coins became a global phenomenon, with Aegina, Samos, and Miletus minting for Egyptians through the trading post of Naucratis in the Nile Delta.

Lydia’s conquest by the Persians in 546 BCE marked the introduction of coins to Persia.

Phoenicians joined the coinage scene in the 5th century BCE, spreading rapidly to Carthaginians in Sicily. The Romans joined the minting league in 326 BCE.

India, influenced by the Achaemenid Empire and the successors of Alexander the Great, witnessed the introduction of coins, especially bilingual ones during the Indo-Greek kingdoms in the 2nd century BCE.

Noteworthy among these coins were those minted by Samudragupta (335-376 CE), showcasing both his conquests and musical prowess.

The initial coins were crafted from electrum, an alloy of silver and gold.

image: electrum coin, source: Wikipedia

Interestingly, early Lydian coins were likely merchant tokens for trade transactions.

These coins often featured legends, like the enigmatic dedication on a Carian coin reading ‘I am the badge of Phanes,’ leaving Phanes’ identity unresolved.

Meanwhile, in China, the Qin Dynasty (221-207 BCE) standardized gold coins.

After the fall of the Qin dynasty, the Han emperors introduced silver coins and ‘deerskin notes,’ a precursor to paper currency—a remarkable Chinese innovation.

3. Paper Money: A Chinese Innovation

Tracing back to the Tang dynasty China in the 7th century, paper currency, also known as ‘flying money,’ made its debut, although true paper money emerged later during the Song dynasty in the 11th century.

The use of paper currency spread through the Mongol Empire and Yuan dynasty China, with European explorers like Marco Polo introducing the concept in 13th century Europe.

Napoleon even issued paper banknotes in the early 1800s.

The evolution of paper money is intertwined with the changing perception of banknotes.

Originally based on precious metals, banknotes were seen as promissory notes, a promise to pay in precious metals.

Over time, banknotes transformed into pure fiat money, especially with the removal of precious metals from the monetary system.

In China, the first banknote-type instrument was used during the Tang dynasty in the 7th century.

Merchants issued promissory notes as receipts to wholesalers, enabling large transactions without the bulk of copper coinage.

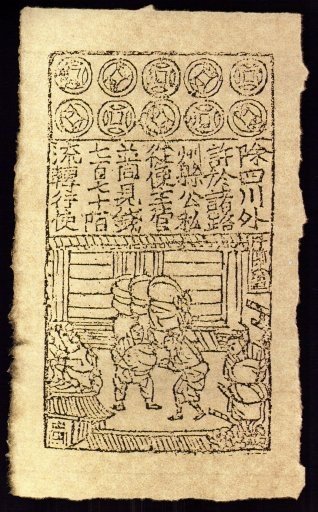

True paper money, called ‘jiaozi,’ developed during the Song dynasty, initially as a promise to redeem for specie.

Jiaozi paper money, source: Wikipedia

The central government recognized the economic advantages and started producing state-issued paper money by the early 12th century, using woodblock printing.

The Song government amassed large amounts of paper tribute and established government-run factories for paper money production.

By 1265-1274, a nationwide paper currency standard was introduced, backed by gold or silver, marking a significant shift.

The founder of the Yuan dynasty, Kublai Khan, issued paper money known as Jiaochao, eventually facing shortages and issuing money without restrictions on duration.

This Chinese innovation impressed Venetian merchants, as Chinese paper money was guaranteed by the state.

4. Banking and the Renaissance: A Renaissance in Finance

Fast-forward to the Renaissance era, a time of intellectual and economic resurgence.

The roots of modern banking trace back to ancient civilizations, around 2000 BC, with the merchants of Assyria, India, and Sumer providing grain loans to farmers and traders.

In ancient Greece and the Roman Empire, lenders in temples extended loans while accepting deposits and facilitating currency exchange.

Similar evidence of money lending is found in archaeological records from ancient China and India.

Scholars often pinpoint medieval and Renaissance Italy, particularly Florence, Venice, and Genoa, as the historical birthplace of the modern banking system.

In 14th century Florence, the Bardi and Peruzzi families dominated banking, with the renowned Medici Bank, established by Giovanni Medici in 1397, becoming a symbol of financial prowess.

The oldest continuously operating bank, Banca Monte dei Paschi di Siena, headquartered in Siena, Italy, dates back to 1472.

Banca Monte dei Paschi di Siena, source: Wikipedia

Banking’s evolution spread from northern Italy to the Holy Roman Empire, reaching northern Europe in the 15th and 16th centuries.

Key innovations unfolded in Amsterdam during the Dutch Republic in the 17th century and later in London during the 18th century.

The 20th century witnessed transformative changes in banking operations due to developments in telecommunications and computing, enabling banks to grow significantly in size and geographical reach.

However, the financial crisis of 2007–2008 led to numerous bank failures, sparking debates about the need for stringent bank regulations.

5. The Gold Standard: Stability and Constraints

In the 19th century, the gold standard emerged as a global monetary system, tying the value of currency to a fixed quantity of gold.

This provided stability but posed challenges during economic downturns.

The gold standard, in place from the 1870s to the early 1920s, then from the late 1920s to 1932, and again from 1944 to 1971, when the U.S. terminated convertibility to gold, was characterized by its historical roots, advantages, and eventual challenges.

Historically, the silver standard and bimetallism were more common than the gold standard.

The adoption of a de facto gold standard in Great Britain in 1717 unintentionally influenced its global spread.

It was eventually abandoned during the Great Depression but briefly re-instated after World War II.

However, its inherent volatility and constraints on government policies led to its ultimate abandonment in 1971.

The gold standard’s impact varied, with proponents praising its stability, automaticity, and role as a credible commitment mechanism.

Yet, critics argue it prolonged and deepened the Great Depression.

Gold’s usage as currency began around 600 BCE, but for everyday transactions, silver was predominant until the 18th century.

Britain’s transition from the bimetallic to the gold standard in the 19th century played a pivotal role in its global acceptance.

The gold standard spread to Australia, New Zealand, and the British West Indies, impacting trade and international monetary systems.

The 19th-century gold rushes, particularly in California and Australia, significantly increased world gold supplies and accelerated the adoption of the gold standard globally.

The gold standard’s benefits were realized by a bloc of countries, including Britain, France, and the United States, which became key players in the 19th-century financial landscape.

6. Fiat Currency: Money by Decree

In the 20th century, a pivotal shift from the gold standard marked the advent of fiat currency.

Fiat money, unlike commodity-backed currency, isn’t tied to physical assets like gold or silver.

Instead, it derives its value from government decree and legal recognition as tender.

Following the end of the Bretton Woods system in 1971, major global currencies transitioned to fiat.

Unlike commodity money with intrinsic value, fiat currency lacks inherent worth.

Its acceptance relies on mutual agreement among users, trusting it as a medium of exchange.

Fiat money diverges from representative money, which holds value backed by commodities.

Government-issued fiat banknotes originated in 13th-century China but became prominent in the 20th century.

Since President Richard Nixon’s 1971 decision to suspend the US dollar’s convertibility to gold, global reliance on national fiat currencies has prevailed.

Fiat money encompasses various forms:

- Unbacked by commodities.

- Declared legal tender by authorities.

- State-issued, not convertible or fixed.

- Mandated by government decree.

- An otherwise non-valuable object serving as a medium of exchange (fiduciary money).

The term “fiat” is rooted in the Latin word “fiat,” meaning “let it be done” or an authoritative order.

This departure from the gold standard granted governments flexibility but introduced challenges, including inflation and currency devaluation.

Fiat currency’s value hinges on trust and governmental regulation rather than intrinsic worth, reshaping the dynamics of modern economies.

7. Digital Revolution: Transforming Transactions

As the digital age dawned, electronic banking, credit cards, and online transactions revolutionized the financial landscape.

Digital currencies, a subset of digital money managed, stored, or exchanged on digital computer systems, played a pivotal role in transforming how we perceive and use money.

This category encompasses cryptocurrencies, virtual currencies, and central bank digital currencies, relying on digital databases, centralized electronic systems, or stored-value cards.

Digital currencies share properties with traditional currencies but lack a physical form like banknotes or coins. Instead, their “unclassical physical form” is rooted in computer interactions and server processing power, enabling nearly instantaneous internet transactions.

Not issued by governmental bodies, virtual currencies operate outside legal tender boundaries and facilitate cross-border ownership transfers.

The emergence of digital money dates back to the 1990s Dot-com bubble.

Key milestones include the introduction of e-gold in 1996, PayPal’s USD-denominated service in 1998, and the groundbreaking launch of Bitcoin in 2009, marking the advent of decentralized blockchain-based digital currencies.

Bitcoin’s decentralized nature proved resistant to government regulation attempts due to the absence of central authorities.

Despite initial challenges, such as the shutdown of e-gold by the US Government in 2008 and legal issues with Liberty Reserve, digital currencies gained momentum.

In China, Q coins on Tencent QQ’s messaging platform, introduced in 2005, had a significant impact on the Chinese Yuan currency through speculation.

While digital currencies brought unparalleled efficiency to transactions, concerns about security and privacy accompanied this technological leap.

The ongoing evolution of digital currencies, with Bitcoin leading the way, reflects a profound shift in the global monetary landscape.

8. Cryptocurrencies and the Bitcoin Revolution

Cryptocurrencies have undergone a transformative evolution, with their roots deeply embedded in the quest for decentralized digital currencies.

The concept of digital currency was introduced as early as the 1980s, with David Chaum’s ecash and later attempts like Adam Back’s Hashcash in 1997 and the proposals for distributed digital scarcity-based cryptocurrencies by cypherpunks Wei Dai and Nick Szabo in 1998.

However, these early attempts faced challenges such as centralized control, susceptibility to double-spending, and vulnerability to Sybil attacks.

In this dynamic landscape, Bitcoin emerged in 2009 as the first decentralized cryptocurrency, marking a paradigm shift.

Satoshi Nakamoto, an enigmatic figure, introduced Bitcoin through a white paper titled “Bitcoin: A Peer-to-Peer Electronic Cash System” in 2008.

Nakamoto implemented the Bitcoin software as open-source code in January 2009.

Bitcoin operates on a peer-to-peer network where transactions are verified through cryptography and recorded in a public distributed ledger called a blockchain.

The consensus mechanism, proof-of-work, involves computationally intensive mining, contributing to concerns about its environmental impact.

Bitcoin’s invention aligns with a free-market ideology, emphasizing decentralization and limited government intervention.

Over the years, Bitcoin has witnessed various phases, from its early use in transactions, like the famous purchase of pizzas in 2010, to its adoption as legal tender in El Salvador in 2021.

Source: x.com

Despite its initial goal as a currency, Bitcoin has evolved into more of a store of value than a medium of exchange.

Its pseudonymous nature has raised concerns about its use in illicit activities, leading to regulatory scrutiny and bans in some countries.

The broader cryptocurrency landscape includes more than 25,000 digital currencies as of 2023, with Bitcoin remaining the most widely used and accepted.

Cryptocurrencies, operating on decentralized systems like blockchain, challenge traditional notions of currency by eliminating the need for central authorities in transactions.

While they share similarities with traditional currencies, cryptocurrencies, including Bitcoin, are generally viewed as a distinct asset class.

Their decentralized nature, enabled by blockchain technology, ensures transparency, security, and resistance to censorship, albeit accompanied by ongoing debates on environmental impact, regulation, and market stability.

Charting the Future: Cryptocurrencies, Bitcoin, and the Evolution of Money

In conclusion, the journey of money’s evolution from barter systems to cryptocurrencies, with a focus on Bitcoin, reflects the relentless pursuit of innovation and financial efficiency.

The advent of digital currencies, spearheaded by Bitcoin’s decentralized blockchain technology, has undoubtedly disrupted traditional financial landscapes.

Looking ahead, the future of money seems poised for continued transformation.

While cryptocurrencies face challenges such as environmental concerns and regulatory uncertainties, their trajectory suggests an enduring impact.

It is conceivable that governments and financial institutions might further explore the integration of blockchain and digital currencies into mainstream financial systems.

The concept of decentralized, borderless, and transparent financial transactions, championed by cryptocurrencies, could become more ingrained in our global economy.

As technology continues to advance, we may witness the rise of more efficient and sustainable consensus mechanisms, addressing the environmental criticisms associated with proof-of-work systems.

Additionally, the convergence of traditional finance and the crypto space could pave the way for novel financial instruments and services.

Central bank digital currencies (CBDCs) might play a pivotal role, providing governments with greater control and oversight while retaining the advantages of digital transactions.

In this evolving landscape, the balance between innovation, regulation, and sustainability will be crucial.

It remains to be seen whether cryptocurrencies will become ubiquitous in day-to-day transactions or maintain their role predominantly as a store of value.

The financial future will likely be shaped by a delicate dance between technological progress, regulatory frameworks, and societal acceptance.

As we navigate this dynamic era of financial evolution, one thing is certain – the journey from barter to Bitcoin is a testament to humanity’s unwavering pursuit of more efficient, transparent, and inclusive means of conducting economic transactions.

Interesting Fact: The Forever Lost Bitcoin

Did you know that approximately 3.7 million bitcoins have likely vanished into the digital abyss, forever out of circulation?

This amount accounts for roughly 18% of the total bitcoins that can ever exist.

The enigma behind these missing bitcoins lies in the unfortunate mishaps of lost wallet keys and transactions sent to incorrect addresses.

The irreversible nature of these transactions renders these bitcoins inaccessible, contributing to the scarcity of an already rare asset.

If we do the math, those 3.7 million lost bitcoin equal to $155.4 billion ( as of 30.01.2024 ) – we’re looking at a substantial amount of lost value.

This intriguing fact serves as a timely reminder of the importance of safeguarding your crypto investments.

Take a moment to reflect on the significance of keeping your wallet keys secure and always double-checking the recipient’s address before hitting that send button.